golden state tax credit

Check if you qualify for the Golden State Stimulus II. Had wages of 0 to 75000 for the 2020 tax year.

Golden State Fourth Stimulus Checks Worth 1 100 Sent Out This Week In California Here S When Yours Will Arrive

CalEITC4Me is a groundbreaking public-private program focused on the California Earned Income Tax Credit CalEITC a cashback tax credit that puts money back into the pockets of low-income Californians.

. You will need to file your 2020 California state tax return by October 15 2021 in order to receive your California stimulus check. Get the latest business insights from Dun Bradstreet. Line 16 on Form 540 2EZ.

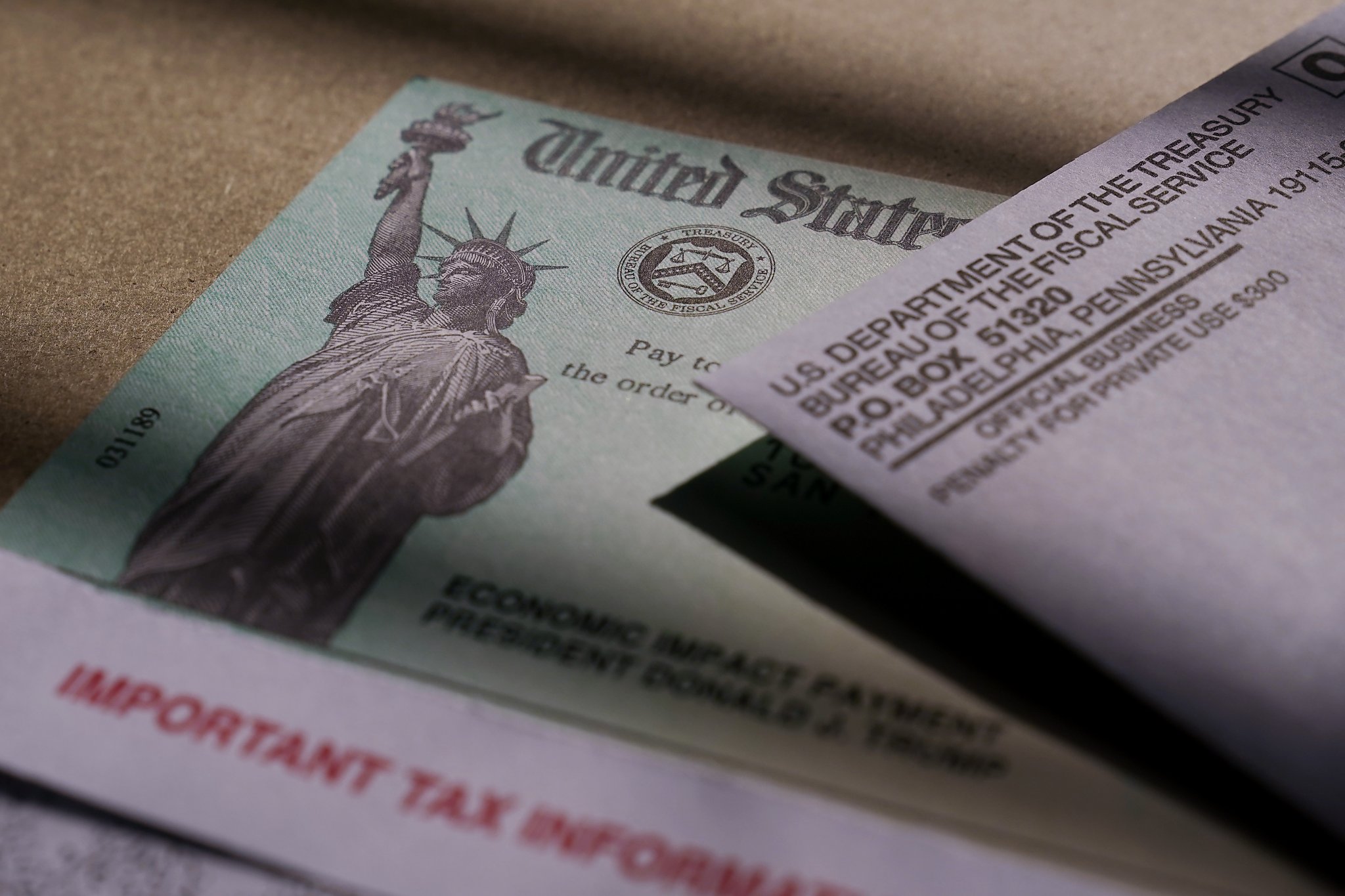

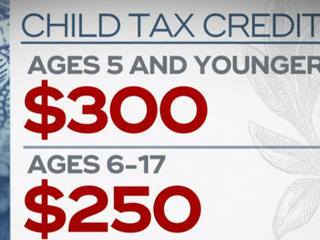

Families claiming the CTC received up to half of the 3000 per qualifying child between the ages of 6 and 17 and 3600 per. Did not qualify for GSS I and meet the GSS II eligibility criteria or. Starting in mid-2021 through the Advance Child Tax Credit families who claim the Child Tax Credit received monthly deposits or paper checks directly from the IRS.

Has sought to streamline and simplify your California Tax Education Council CTEC continuing education CE requirement. The Earned Income Tax Credit EITC is a refundable tax credit for eligible workers and families with low to moderate-income. For this information refer to.

The remaining 80 of mortgage interest paid can still be taken as an itemized tax deduction 1. Here is how to claim it. To date we have issued over 25000 courses to approximately 6000 individual tax preparers with the goal of making their and your experience as seamless.

Get Up To 8000 Back On Your Taxes Golden State Stimulus Payment of 600 or 1200. Since July payments have been coming in the form of monthly 300 or 250 per eligible child and will continue through December amounting to half of the total benefit amount. About Golden State Tax Training Institute.

Met the GSS I or II criteria and claimed a credit for one or more dependents. Here you will find helpful information about financial assistance programs for homebuyers and homeowners including down payment assistance mortgage credit certificates multi-family financing and energy efficiency financing. This is a one-time 600 or 1200 payment per tax return.

CalWORKs SSISSP and CAPI participants and recipients of other benefits may qualify for the one-time 600 Golden State Grant. California has signed the Golden State Stimulus which includes 600-1200 cash payments to eligible residents. Since its founding in 1983 Golden State Tax Training Institute Inc.

Had a California Adjusted Gross Income CA AGI of 1 to 75000 for the 2020 tax year. How to claim 1200 income tax credit in California. California provides the Golden State Stimulus to families and individuals who qualify.

Those who qualify for EITC andor Cal EITC and claim the credits could pay less in taxes or even get a tax refund up to 8000. CalEITC4Me Golden State Opportunity. For a family eligible.

California will provide the Golden State Stimulus payment to families and individuals who qualify. You can receive both this grant and the Golden State Stimulus if you qualify. This is a stimulus payment for certain people that file their 2020 tax returns.

Book Option - 6995. California will provide the Golden State Stimulus payment to families and individuals who qualify. We are an IRS Approved and CTEC Approved Provider of continuing education and qualifying educationCE and QE.

In 2021 the Child Tax Credit was increased thanks to the American Rescue Plan. Find company research competitor information contact details financial data for Golden State Tax Business Service of Rocklin CA. You may receive this payment if you receive the California Earned Income Tax Credit CalEITC or file with an Individual Taxpayer Identification Number ITIN.

We strive to look for new and responsive ways to make your. Visit Golden State Grant Program California Department of Social Services website for more information. You may receive this payment if you file your 2020 tax return and receive the California Earned Income Tax Credit CalEITC.

Our multi-channel multicultural outreach campaign builds awareness of and claims for the CalEITC each year. We provide high quality and cost effective courses for Tax Professionals since 1983. Golden State Tax Training Institute has been a CTEC approved provider for both Continuing Education for over 30 years and we have a course that will meet your requirement.

Golden State Grant Program. Filed your 2020 taxes by October 15 2021. Welcome to Golden State Finance Authoritys GSFA website.

To qualify you must have. We focus on customer service and satisfaction. The Golden State Stimulus aims to.

500 payment to qualified recipients who file with a Social Security Number qualified for GSS I and claimed a credit for one or more dependents. Line 17 on Form 540. California lawmakers have approved the Golden State Stimulus bill which could see individuals able to claim up to 1200.

Support low and middle income Californians. The California Tax Education Council CTEC requires all CRTPs to complete 20 hours of Continuing Education from an approved education provider. Golden State Stimulus I.

Eligibility is based on your 2020 tax return the one you file in 2021. The MCC rate for the GSFA MCC Program is 20 so 20 of the annual mortgage interest paid can be taken as a tax credit. The Golden State Stimulus aims to.

The MCC remains in effect for the life of the mortgage loan so long as the home remains as principal residence.

California Stimulus Checks See When Your Zip Code Will Receive A Payment Kget 17

600 For Ssi Ssp Recipients Is Approved In New Golden State Stimulus Package

Golden State Stimulus I Ftb Ca Gov

Here S When The Next Batch Of California Stimulus Checks Will Be Released

Will You Get A Check Final Round Of California Stimulus Payments Due By Jan 11

Golden State Stimulus Tracker Who Will Receive The Next Payments Marca

Golden State Stimulus Update Date Amount And Eligibility Marca

California Golden State Stimulus Turbotax Tax Tips Videos

.png)

California Golden State Stimulus Turbotax Tax Tips Videos

California Stimulus How To Track Golden State Payments Marca

A Fourth Stimulus Check From Your State Check The List Of Covid Relief Payments

Caleitc4me Golden State Opportunity

Stimulus Checks Some States Are Issuing Checks And Bonuses To Millions Of Residents Cbs News

Golden State Opportunity Gsopportunity Twitter

California Golden State Stimulus Checks Info For Nonresidents

Golden State Fourth Stimulus Checks Worth 1 100 Sent Out This Week In California Here S When Yours Will Arrive

People In California Can Get New Golden State Stimulus Checks

Fourth Stimulus Check Update Deadline Approaching For 1 400 Payment