starting credit score canada

If youre carrying a balance of 5000 on a card with a 10k limit your. 1-800-663-9980 except Quebec Tel.

Rbc Credit Score Free Transunion Credit Report In Canada Wallet Bliss

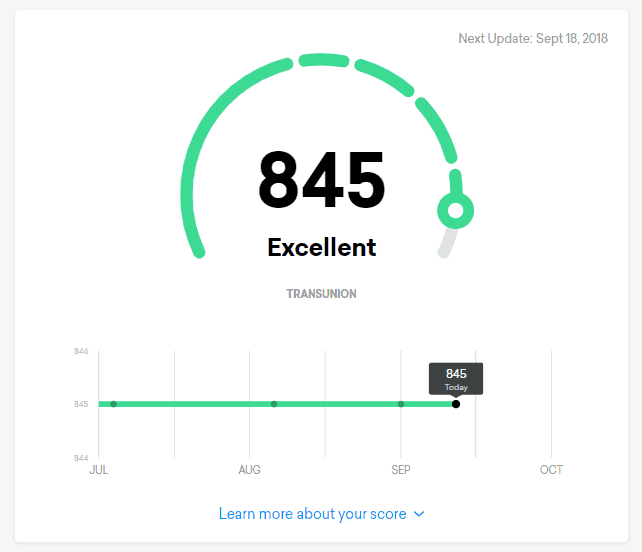

The top score in Canada is 900 points which is about the level of credit you can get at any time.

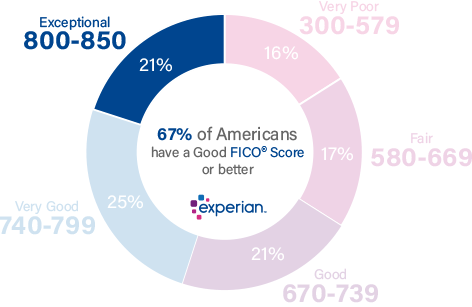

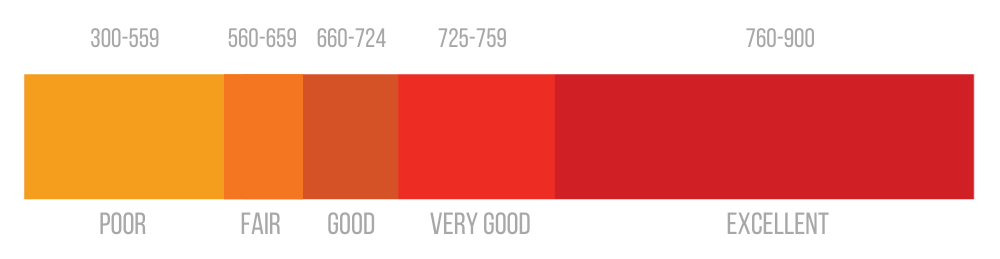

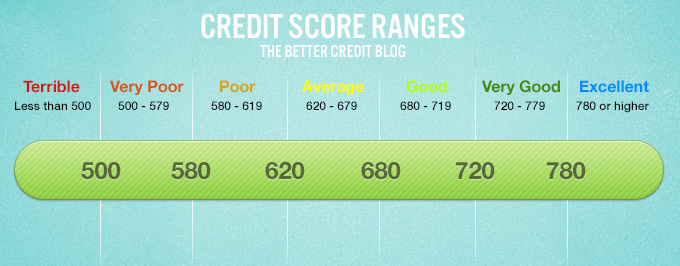

. In reality everyone starts with no. Scores from 725 to 759 are considered very good. For example Canadian credit scores range from 300-900 while US credit scores range from 300-850.

Scores from 660 to 724 are considered good. Good 660 724 Very Good 725 759 and Excellent 760 900. A good credit score in Canada is 660 or higher.

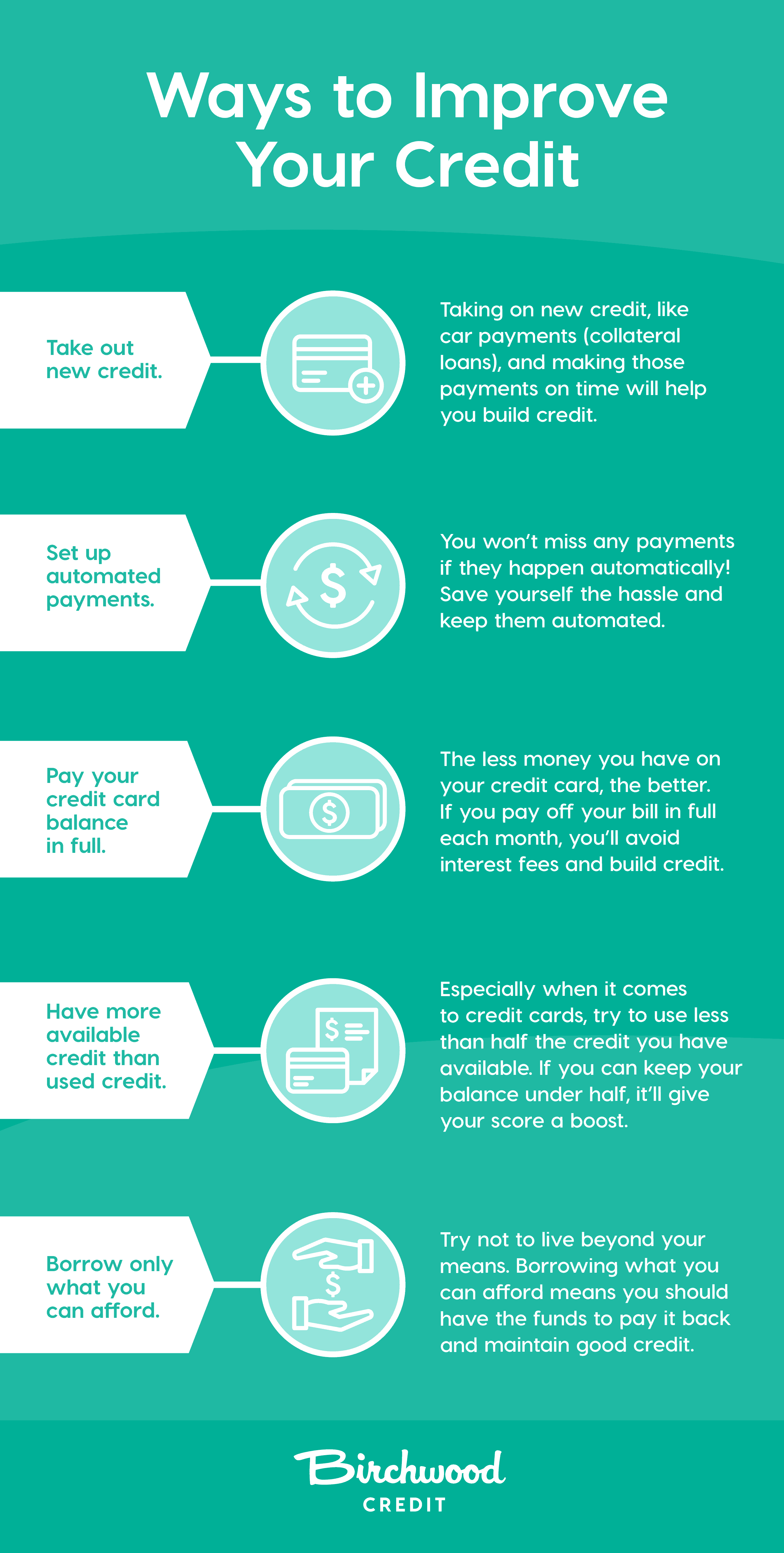

Similarly a foreclosure means a credit score falls 140-160 points if your original credit score was 780 but falls only 85-105 if your original credit score was 680. Accepting an increase in your credit limit will lower your credit usage percentage immediately. Heres what youll earn for.

Checking Wont Impact Your Score. Get A Heads-Up On Your Credit. In Canada credit scores can be as high as 900 and as low as 300 but dont worry.

Youre Approved Now Let Us Build Your Credit Score. Theres No Better Solution Than Refresh. Ad Chase Credit Journey.

What Credit Score Do You Start Off With Canada. Why Pay 1 or Sign Up For A Trial When You Can Get Your Score For Free - Every Week. If you want to view your credit report online for faster access you have to pay a fee.

While both share FICOs common credit score model the average credit score in Canada. To understand how credit score and missed payment trends across Canada have changed during COVID-19 measures Borrowell a fintech company that offers free weekly. Ad Canada Weve Got a Card for You.

The best Visa credit card only requires a good credit score the RBC Avion Visa Infinite. To order your credit report by phone. The ranges on the good side of things are.

Ad Get Your Credit Score in Less Than 3 minutes. Ad Get Your Credit Score in Less Than 3 minutes. Get the info you need to take control of your credit.

Credit Karma offers free credit scores reports and insights. TransUnion suggests that you. If you want to get a good deal on a credit card.

Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a credit card. Call 1-800-465-7166 for Equifax. Why Pay 1 or Sign Up For A Trial When You Can Get Your Score For Free - Every Week.

Ad Guaranteed Approval And No Credit Checks. Although ranges vary depending on the credit scoring model generally credit scores from 580 to 669 are. Choose a Mastercard from Capital One Canada That Works for You.

A 2015 study commissioned by the Bank of Montreals Wealth. Your credit score is a number between 300 and 900 that tells lenders in Canada how trustworthy you are as a borrower. Its better to have space left unused in.

The answer may surprise you. Sign Up for Free Critical Alerts About Your Credit Report. Its d none of the above.

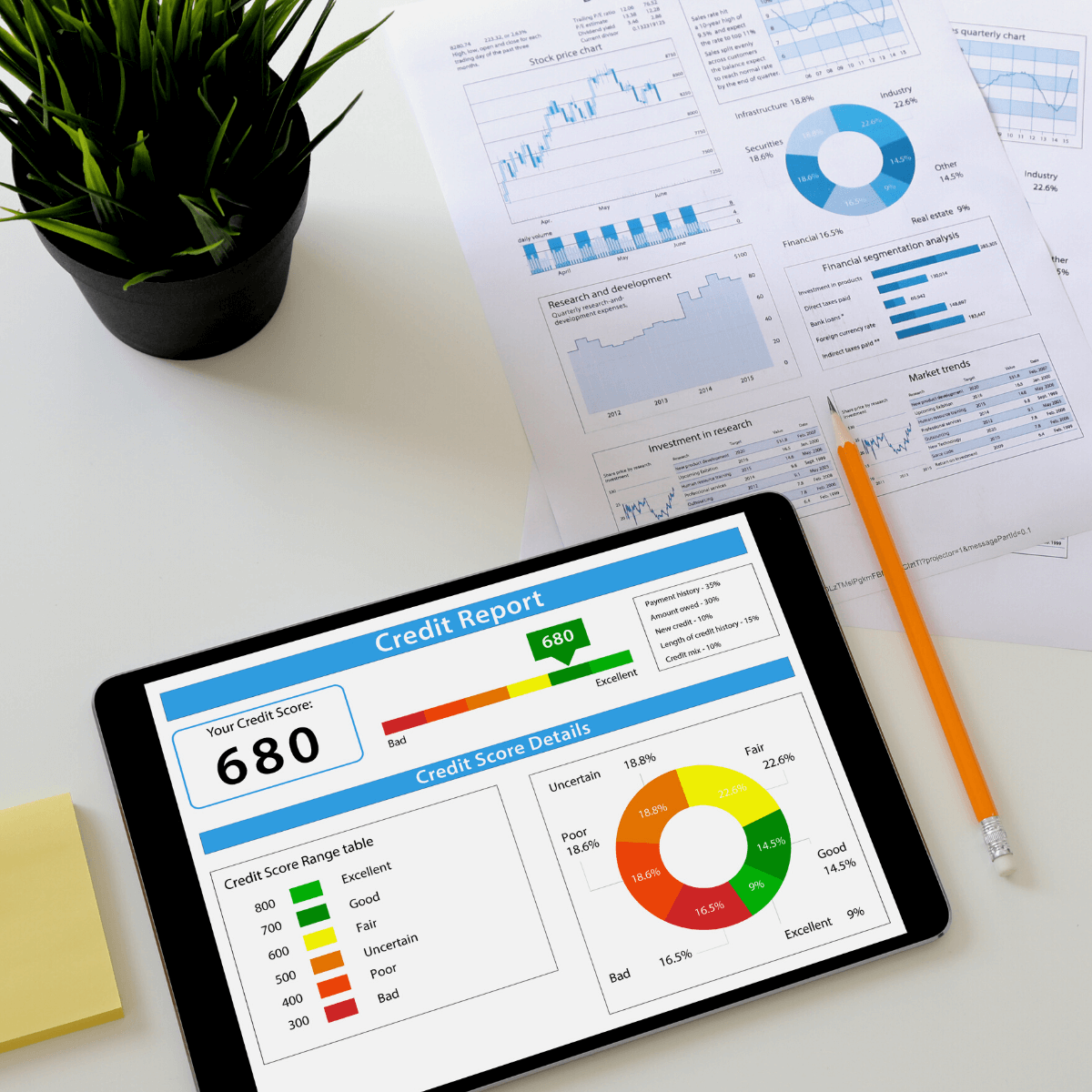

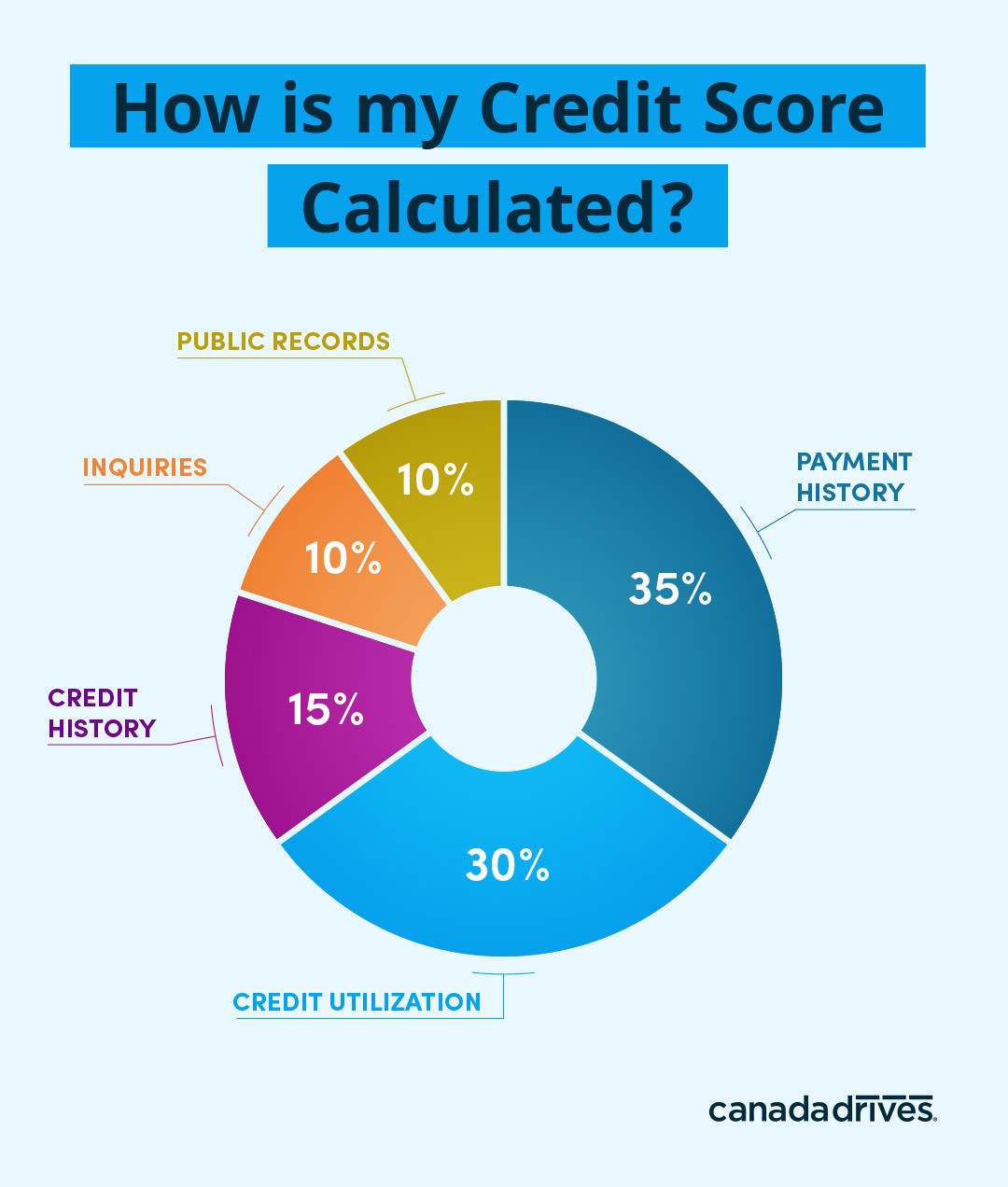

According to Equifax Canada one of Canadas major credit bureaus the average credit score amongst Canadians from 10 years ago to today has fallen in every age bracket but. If youve never had credit activity a credit card or loan or instance you wont start at 300. One factor in determining your credit score is your credit utilization available credit vs.

Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a mortgage credit. Guaranteed Rewards Low Rate Secured. With the right approach you can start seeing significant improvements in your credit score in as little as.

It varies and will depend on how bad your credit score is to start with. Your credit score is a three-digit number that comes from the information in your credit report. Scores from 760 and up are considered excellent.

Credit risk is the likelihood youll pay your bills on time or pay back a loan on the. However there are some general score ranges that show how good or not a score is. Heres how it works.

It offers a mix of high rewards perks and insurance. Your credit score is a three-digit number between 300 and 900 that represents your credit risk. Do you begin at a the highest possible credit score b the lowest or c somewhere in between.

It shows how well you manage credit and how risky it would be for a lender to lend you money. Dont use the entire limit on credit card. Scores above 660 typically mean youre low.

Checking Wont Impact Your Score. Call the credit bureau and follow the instructions. It can be difficult starting a brand new life in a new country especially when it comes to establishing credit.

No Chase Account Required.

800 Credit Score Is It Good Or Bad

Understanding Your Credit Score And Why It Matters Envision Financial

600 Credit Score Is It Good Or Bad

What Is A Good Credit Score Forbes Advisor

Credit Karma Canada Review 2022 Free Credit Score And Report

What Is The Average Credit Score In Canada By Age Loans Canada

What Is A Good Credit Score Td Canada Trust

A Convenient Secure Way To See Where Your Credit Stands Rbc Royal Bank

Everything You Need To Know About Credit Scores Canada Drives

What Is The Average Credit Score In Canada By Age Loans Canada

620 Credit Score How To Improve Your 620 Credit Score

Credit Report In Canada What You Need To Know Nerdwallet Canada

What Is A Good Credit Score Td Canada Trust

Credit Score Range What Is The Credit Score Range In Canada

What Is The Average Credit Score In Canada By Age Loans Canada

Everything You Need To Know About Credit Scores Canada Drives

What Is The Average Credit Score In Canada By Age Loans Canada